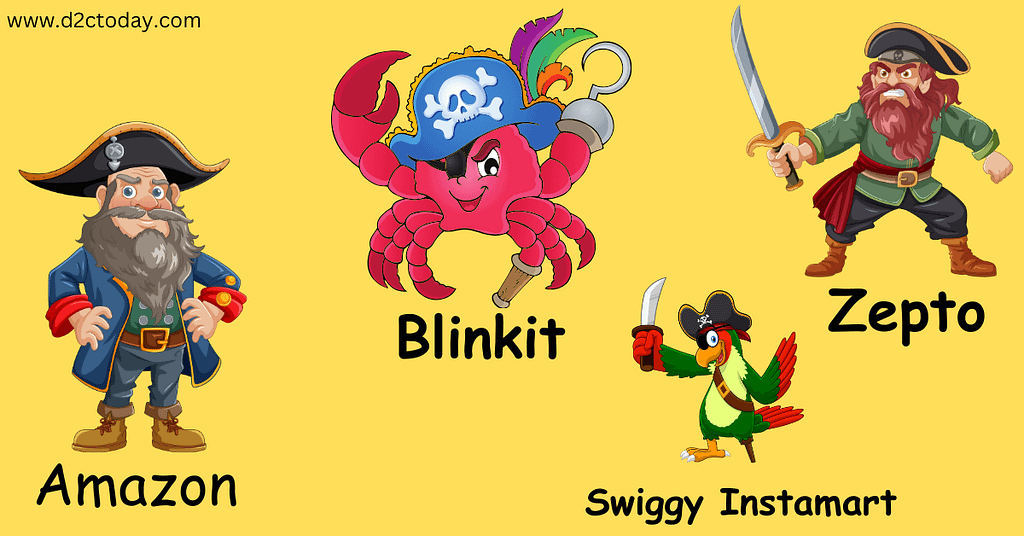

The quick commerce revolution in India has seen the emergence of key players like Blinkit, Zepto, Swiggy Instamart, and Amazon, each bringing unique strategies and innovations to the table. As demand for faster, more convenient delivery services grows, these companies are reshaping the retail landscape, making it possible for consumers to receive groceries and daily essentials within minutes. In this newsletter, we dive deep into comprehensive case studies of these trailblazers, analyzing their growth metrics, the challenges they face, and their future plans as they continue to redefine India’s shopping experience in the age of instant gratification.in this newsletter we will Understand how Quick commerce in India is shaping up the retail Landscape ? and how they are prepared for epic battle ?

Blinkit (formerly Grofers)

Founded in 2013, Blinkit initially operated as a scheduled grocery delivery service. By 2021, it pivoted entirely to quick commerce, introducing the 10-minute delivery model and rebranding itself as Blinkit. Backed by Zomato, the platform now delivers groceries, essentials, and household goods across India.

Key Milestones

- 2021 Pivot: Blinkit transitioned to q-commerce, shutting down non-profitable regions and consolidating operations.

- Funding: Raised $300 million in funding from Zomato in 2022 to scale operations.

- Dark Store Expansion: As of 2024, Blinkit operates 1,000+ dark stores across 20 cities, achieving 85% urban coverage.

Strategies

- Strategic Location of Dark Stores: Blinkit used population density and demand heat maps to place dark stores within 2–3 km of high-demand clusters.

- Result: Average delivery times dropped to 8–10 minutes in top-tier cities.

- Tech-Driven Operations: Blinkit integrated AI and machine learning to optimize inventory and predict demand.

- Impact: Reduced stockouts by 15% in 2023.

- Synergy with Zomato: Blinkit leverages Zomato’s logistics network during peak hours.

- Example: During Diwali 2024, Zomato riders completed 20% of Blinkit deliveries, helping manage demand spikes.

Financial Performance

- Revenue Growth: ₹4,000 crore ($480 million) in FY 2024, up from ₹2,200 crore in FY 2022.

- Losses: Operating losses narrowed to ₹700 crore in FY 2024, compared to ₹1,200 crore in FY 2022, driven by efficiency improvements.

Challenges

- High Burn Rate: Despite narrowing losses, the company spends heavily on discounts, delivery personnel incentives, and infrastructure.

- Rider Attrition: Blinkit’s delivery executives face tight schedules, leading to a 20% annual attrition rate.

Future Plans

Blinkit aims to expand to tier-2 cities while experimenting with non-food categories like electronics and personal care products. Sustainability initiatives, including a shift to electric delivery vehicles (EVs), are also in the pipeline.

Zepto

Zepto is the quintessential quick commerce startup, founded by two teenagers, Aadit Palicha and Kaivalya Vohra, in 2021. The company gained traction for its hyper-efficient 10-minute delivery model and achieved unicorn status within two years.

Key Milestones

- 2021 Launch: Started operations in Mumbai and Bengaluru with 10-minute deliveries.

- 2023 Funding: Secured $665 million in a Series D round, reaching a valuation of $3.6 billion.

- 2024 Expansion: Grew its network to 700+ dark stores, covering 90% of urban India.

Strategies

- Data-Driven Dark Stores: Zepto employs advanced algorithms to decide inventory levels, ensuring top-selling items are always in stock.

- Result: Reported a 98% order fill rate in 2024.

- Focus on High-Value Products: Zepto introduced premium products like imported snacks, dairy alternatives, and organic groceries, increasing average order value (AOV) by 20%.

- Employee Welfare: Riders earn incentives for completing 10+ deliveries per shift, reducing delivery personnel attrition rates to 12% (among the lowest in the industry).

Financial Performance

- Revenue Growth: Reported a 3x revenue growth in 2024, reaching ₹3,000 crore ($360 million).

- Efficiency: Reduced delivery time variability, achieving a 92% on-time delivery rate.

Challenges

- Competitive Pressure: Zepto faces fierce competition from established players like Swiggy and Blinkit.

- Profitability: The company remains unprofitable due to significant investments in expansion and customer acquisition.

Future Plans

Zepto is experimenting with AI-enabled micro-fulfillment centers to further optimize delivery times. It also plans to expand its product categories, including baby care and pharmaceuticals.

Swiggy Instamart

Swiggy Instamart is the quick commerce arm of Swiggy, India’s leading food delivery platform. Launched in 2020, Instamart has leveraged Swiggy’s extensive delivery infrastructure to capture significant market share.

Key Milestones

- 2022 Growth: Expanded operations to 25 cities, completing 2 million orders per week.

- 2023 EV Initiative: Introduced 10,000 EVs to its fleet, reducing delivery costs by 18%.

- 2024 Product Diversification: Added categories like pet supplies, personal care, and over-the-counter medicines.

Strategies

- Leveraging Swiggy’s Delivery Network: Instamart uses the same pool of delivery partners as Swiggy’s food delivery business, reducing fixed costs.

- Personalized Offers: The app offers dynamic pricing and targeted promotions based on user behavior.

- Example: Users who frequently order snacks receive discounts on bundled snack packs.

- Sustainability Focus: Swiggy partnered with packaging startups to introduce biodegradable delivery bags, reducing plastic waste by 40%.

Financial Performance

- Revenue: Instamart contributed ₹6,500 crore ($780 million) to Swiggy’s overall revenue in FY 2024.

- Customer Retention: Achieved a 70% monthly active user retention rate due to its high service reliability.

Challenges

- Intense Competition: With Blinkit, Zepto, and Amazon entering quick commerce, Swiggy faces pricing wars and shrinking margins.

- Infrastructure Costs: Expanding dark store operations has increased Swiggy’s operational costs by 25% in 2024.

Future Plans

Swiggy plans to integrate AI chatbots into Instamart to enhance customer support and launch hyperlocal subscription services for essentials like milk, bread, and vegetables.

Amazon India’s Quick Commerce

Amazon India entered the quick commerce market in late 2024, leveraging its existing logistics and fulfillment infrastructure to pilot 15-minute deliveries. This move positions Amazon as a formidable competitor to Blinkit, Zepto, and Swiggy Instamart.

Key Milestones

- 2024 Pilot: Launched 15-minute delivery trials in Bengaluru and Delhi NCR.

- 2025 Expansion Plans: Aims to cover 20 cities by mid-2025.

- Prime Integration: Quick commerce is now part of Amazon Prime, increasing subscriber benefits.

Strategies

- Hyperlocal Logistics: Amazon repurposed its local delivery hubs to fulfill quick commerce orders.

- Result: Achieved a 95% on-time delivery rate in pilot cities.

- Product Diversification: Unlike competitors focusing on groceries, Amazon’s quick commerce offering includes electronics, beauty products, and even books.

- AI-Powered Fulfillment: Amazon’s proprietary AI algorithms dynamically assign orders to hubs and riders, optimizing efficiency.

Financial Performance

- Customer Adoption: Quick commerce orders grew 30% month-over-month during the pilot phase.

- Prime Membership Boost: Amazon Prime subscriptions increased by 12% in cities where quick commerce was launched.

Challenges

- Late Market Entry: Amazon faces the challenge of differentiating itself in a saturated market.

- High Expectations: Being a global leader, Amazon is under immense pressure to deliver flawless service.

Future Plans

Amazon is experimenting with drone deliveries and autonomous vehicles to reduce costs and scale operations. It also plans to integrate Alexa voice shopping for quick commerce orders.

In Summary

As Blinkit, Zepto, Swiggy Instamart, and Amazon flex their muscles in India’s quick commerce battleground, the competition is nothing short of a thrilling race to dominate convenience. Each player brings its own firepower—lightning-fast delivery, expansive networks, and innovative customer experiences. But this isn’t just a fight for market share; it’s a battle to shape the future of how India shops. With razor-thin delivery times and ever-evolving strategies, the stakes couldn’t be higher. The question remains: who will emerge as the ultimate champion in this high-speed arena? One thing’s certain—the real winner is the empowered, convenience-craving Indian consumer.

Resources Used

2 thoughts on “Blinkit, Zepto, Swiggy, Amazon: The Yodhas of Quick Commerce in India”

Regards for helping out, good info .

I found your blog website on google and verify a couple of of your early posts. Continue to maintain up the superb operate. I simply further up your RSS feed to my MSN Information Reader. Searching for forward to studying more from you in a while!…