Indian Startup funding 2025 is shaping up to be a pivotal year for Indian startups with fintech, AI-powered SaaS, and targeted e-commerce pulling in record investments. Here’s your deep dive into the sectors that are thriving, the numbers you can’t ignore, and where the next wave of growth is headed.

Why Indian Startup Funding 2025 Is Must Watch ?

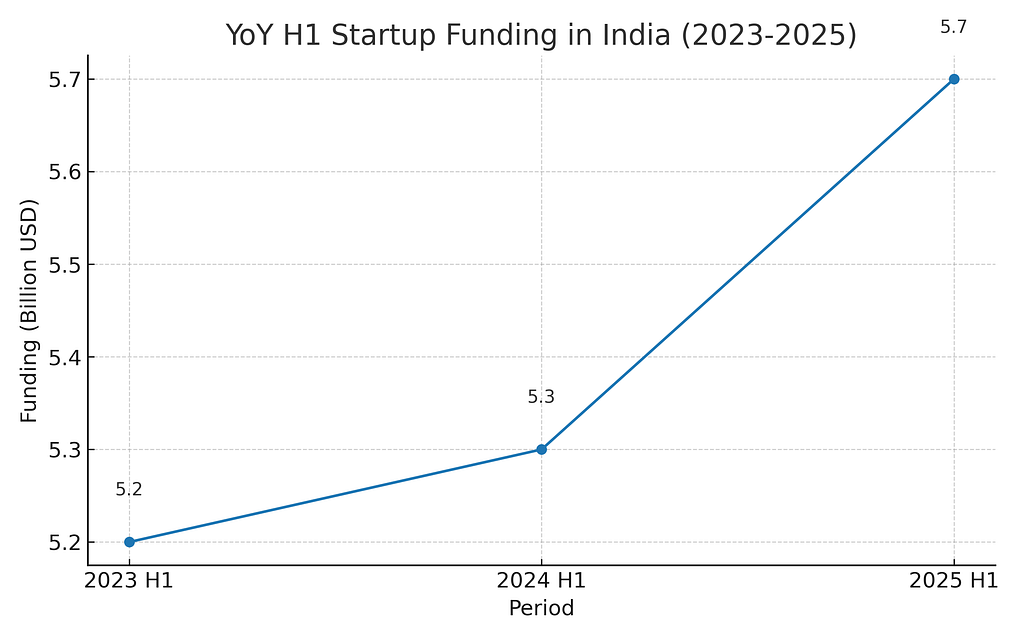

India’s startup ecosystem is growing up 2025’s funding story is no longer about hype, but about savvy, scale, and strategic bets. In the first half of 2025 alone, Indian startups raised approximately $5.7 billion across roughly 470 deals, an 8% YoY increase compared to H1 2024. Not a boom, but a clear sign of recovery and maturity following a bit of turbulence in 2022–2023. And that full-year 2024 tally? A healthy $13.7 billion in VC funding. Source – Bain Inc

This isn’t the frothy dash of 2021, it’s a measured, evolving landscape where investors reward traction, defensibility, and real unit economics.

What’s Driving the Capital?

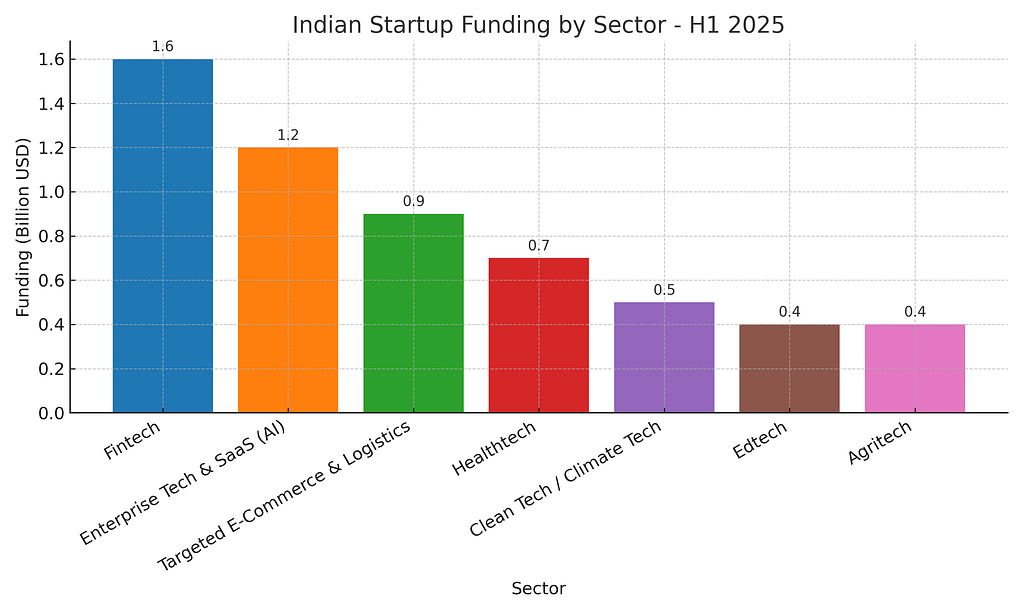

Within those numbers, a few sectors are stealing the spotlight:

Fintech: Still in First Place

- Fintech grabbed top attention with roughly $1.6 billion of funding in H1. Highlights include embedded finance (think “pay-in-wallet,” seller credit), merchant lending, and AI-powered underwriting.

- Why this matters: The large addressable market (especially SME and B2B), the growth of UPI, and greater regulatory clarity are fueling investor confidence.

Enterprise Tech & SaaS (Especially AI-Enabled)

- Startups offering AI-native SaaS products had a strong showing. Investors and corporate buyers love recurring revenue, scalable margins, and tech that’s “acquirable.”

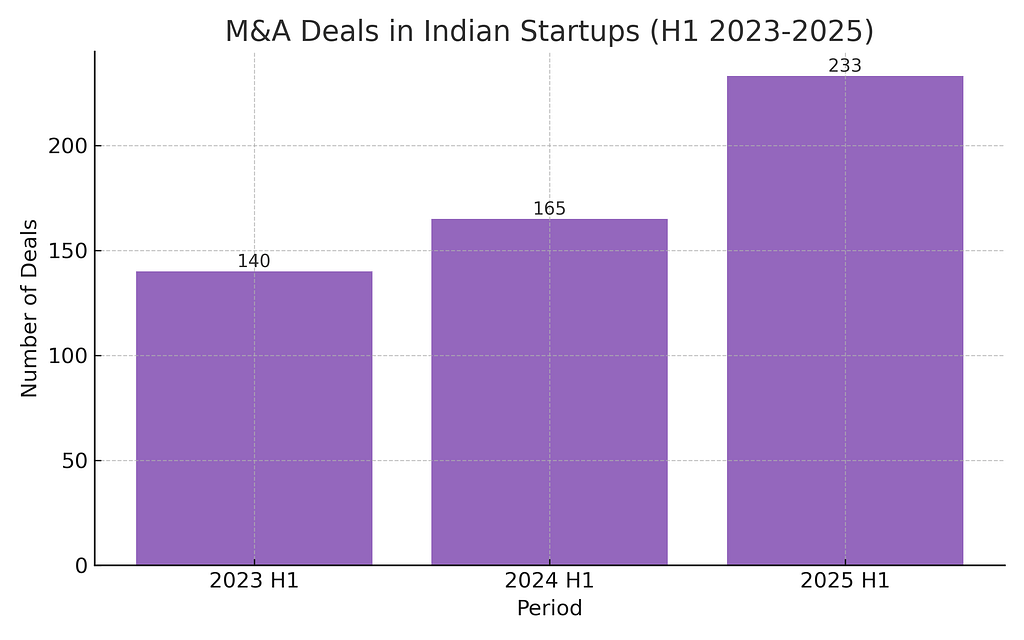

- Notably, M&A deals in the enterprise tech space surged—about a 41% increase year-over-year. There’s a strategic tilt toward buying innovation, not building it.

Targeted E-Commerce & Logistics

- It’s not all retail startups anymore. Funding favored vertical marketplaces (like grocery, health & beauty) and logistics-tech firms that offer better margins and operational defensibility.

- The lesson: narrow, well-defined plays are outpacing general e-commerce.

Healthtech — More Credibility, Less Flash

- Investors are betting on platforms with real traction: chronic care, telemedicine, and device-enabled services with recurring subscriptions.

- Emphasis is on compliance, clinical outcomes, and sustainable revenue—not just user acquisition.

Clean Tech / Climate Tech — Emerging Momentum

- Renewable energy and climate-focused startups are attracting more growth-stage capital, backed by India’s strong policy push and global sustainability pressure.

- These companies often lean on structured capital and offtake guarantees, making them promising plays.

Edtech & Agritech — Quiet Strength

- Select players in upskilling edtech and farm-to-market agritech continue to secure funding. The differentiator? Measurable outcomes, certification, and even partner-based monetization models.

Stage Landscape & Funding Patterns

Early-stage funding remains alive—but not as loose as before. Seed rounds are more cautious, with more rigorous scrutiny and normalized valuations. On the flip side, growth and late-stage rounds are back with bigger checks—particularly for companies showing revenue, retention, and solid unit economics.

Key takeaway for founders: Tailor your story. Present both your early traction story (cohorts, CAC/LTV, path to profitability) and your scalable growth roadmap.

Geography Still Matters

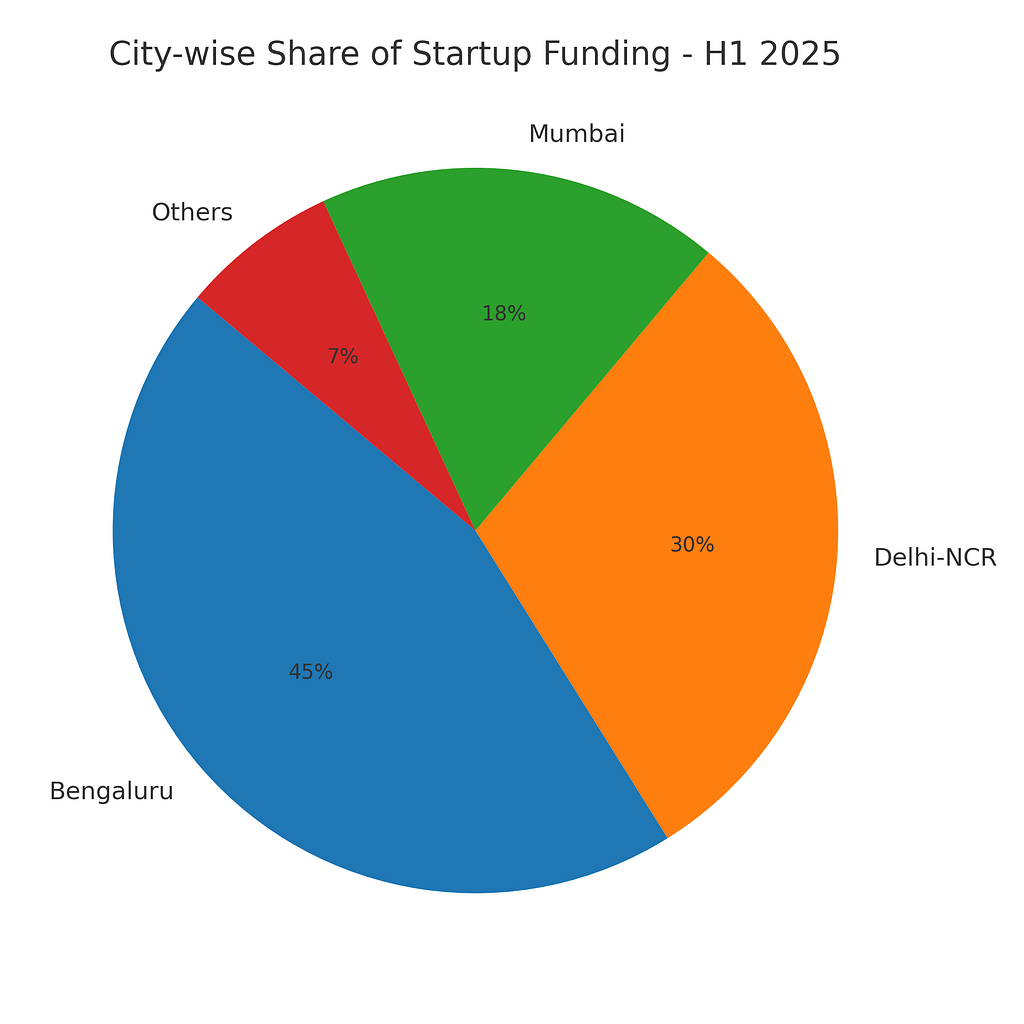

Yes, remote work is big—but money still favors tier-1 hubs. Bengaluru, Delhi-NCR, and Mumbai hauled about 93% of H1 2025 funding. Tier-2 cities like Pune, Hyderabad, and Chennai are growing, but capital density remains with the big three.

A smart model? Hybrid hubs: keep R&D or engineering cost-effective in tier-2, and maintain sales or investor outreach presence in tier-1 hubs for proximity.

M&A as a Liquidity Path

With exits via IPO still limited, many founders are turning to M&A. The 41% increase in deals indicates that enterprise tech and fintech startups are increasingly viewed as bolt-on acquisitions by larger players. Building “acquirability” into your product roadmap—through integration readiness, revenue synergies, or cost savings—can fast-track exit options.

Three Insight Nuggets You Didn’t Expect

- More dollars, fewer shavings — fewer micro-seed rounds, but larger early-stage checks for high-potential teams.

- SaaS + AI = M&A magnet — enterprise incumbents would rather buy ready AI solutions than build them in-house.

- Location still shapes capital — startups benefit from being in investor hotspots, especially for meaningful rounds and strategic deals.

Actionable Playbooks — What You Can Do Today

E-Commerce Managers

- Run a 30–90 day pilot with an embedded fintech partner (BNPL or seller credit).

- Map your fulfillment costs by SKU, pilot an AI-based returns optimization (target a 10% cut), and renegotiate logistics SLAs.

Startup Founders

- Update your pitch with a 12-month revenue and runway plan.

- Create a 1-page M&A readiness document—clearly show synergies, cost savings, or channel logic for an acquirer.

Tech Professionals

- Deliver a real proof-of-concept in ML Ops or prompt engineering (~30 days) and track cost/performance gains.

- Document cloud cost optimization results (10–20% savings) as a quick case study.

Investors & Analysts

- Launch a funding dashboard: compare H1 vs H2 flows, median tickets, sector concentration.

- Reserve dry powder (20–30%) for late-stage plays, and cultivate relationships with corporate VC arms.

Business News Readers

- Follow Inc42’s H1 2025 funding report and Bain’s VC trend data.

- Bookmark or build a live funding tracker for India’s startup ecosystem.

Final Thought

Indian startup funding in 2025 is anything but chaotic. It’s smarter. Investors are rewarding stickiness, defensibility, and clear scalability—not vanity metrics. Fintech and AI-enabled SaaS are the epicenters. Climate tech is quietly gaining engine-room strength. E-commerce works when it’s specialized. And healthtech, edtech, agritech survive when backed by tangible value.

Founders: focus your stories on results, not buzz. Investors: lean into strategic, growth-stage value. E-commerce and tech pros: pick pilots that showcase measurable impact. This is maturity, not hype—let’s thrive in it.

Join D2C Today and get insider news, funding updates, and actionable growth tips straight to your inbox. Be the first to know, the fastest to grow.