The D2C market in India is projected to surpass $100 billion by 2025, growing at 40% CAGR. With 800+ active brands, the sector is driven by fashion, beauty, food, and electronics, while niches like pet care, nutraceuticals, and sustainable products are emerging. Success requires omnichannel strategies, affordable marketing, and strong customer retention.

D2C Market in India Growth Trends in India’s D2C Landscape

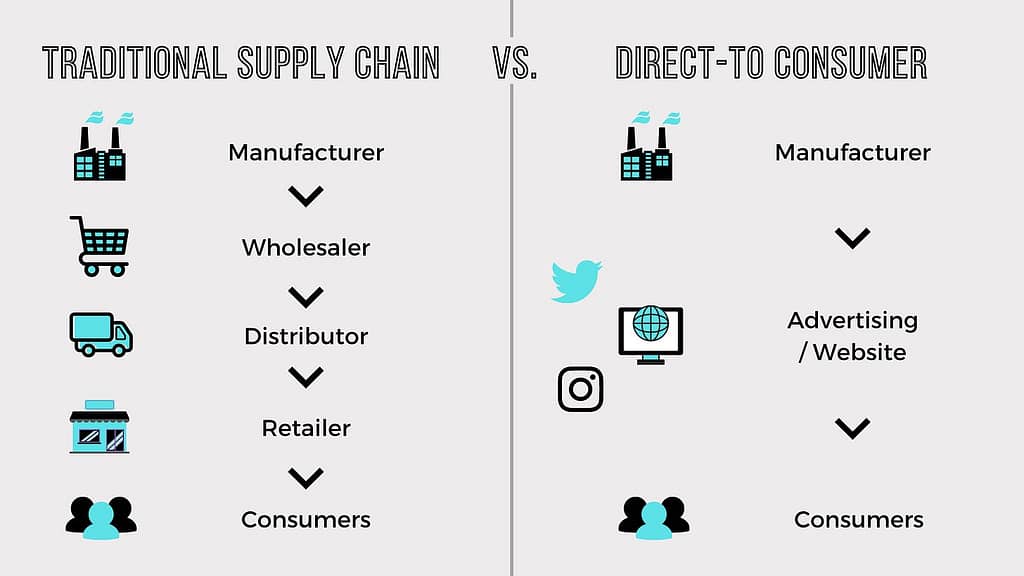

India’s Direct-to-Consumer (D2C) sector has transformed into a major retail force.

- Market Size & Growth

- Worth ~$12 billion in 2022 (KPMG).

- Expected to exceed $60 billion by 2027 (~40% CAGR).

- Some estimates are even higher: $66+ billion in 2023 and projected to hit $100 billion by 2025.

- Over 800 D2C brands already active in India (2024), with the count rising rapidly.

- Growth Normalization Post-Pandemic

- Pandemic lockdowns (2020–21) drove 50–70% growth.

- Growth has now normalized to 25–30% annually, still outpacing traditional retail.

- Funding has become cautious: Q2 2022 saw a 37% drop in e-commerce investment compared to Q1.

- Leading Categories

- Fashion & Apparel

- Beauty & Personal Care

- Food & Beverages

- Consumer Electronics

- Nutraceuticals

- Consumer Drivers

- Millennials & Gen Z driving experimentation with digital-first brands.

- Even traditional conglomerates (e.g., HUL, Tata, ITC) are launching or acquiring D2C brands.

- Omnichannel Expansion

- Brands like Mamaearth, Sugar Cosmetics, Licious moving offline via retail stores.

- Hybrid model is proving more sustainable — combining brand-owned websites (core channel) with marketplaces for reach.

- Marketplaces (Amazon, Flipkart) still contribute ~60% of online retail but reduce margins and dilute branding.

➡️ Bottom Line: The D2C revolution is thriving, but competition is fierce — 1,600+ brands now compete for the same online shoppers.

Top D2C Brands to Watch You Can’t Afford to Miss in 2025

Emerging and Underserved Niche Segments

- Pet Care

- Rising pet ownership → premium pet food, treats, and wellness.

- Market expected to reach $800M by 2028.

- Example: Drools scaling fast.

- Home & Lifestyle

- D2C mattresses, furniture, décor.

- Example: Wakefit (“Right to Nap”) leveraging home delivery + quality positioning.

- Health, Wellness & Nutraceuticals

- Vitamins, functional foods, fitness supplements.

- Consumers want organic, Ayurvedic, clean-label products.

- High AOV and subscription potential.

- Sustainable & Plant-Based Products

- Eco-friendly personal care, biodegradable essentials, vegan foods.

- Growing community of conscious consumers.

- Premium & Custom Niches

- Jewelry (high AOV, ~₹1,800 average per order).

- Bespoke fashion, plus-size wear, luxury ethnic apparel.

- Example: CaratLane, BlueStone scaling omni-channel models.

➡️ These niches are less crowded, with higher AOVs and loyal early adopters.

Buyer Behavior & Preferences (High-AOV D2C Products)

- Demographics:

- Urban Millennials & Gen Z dominate, but 65% of orders now come from Tier-2/3 cities.

- Expectations:

- Quality & personalization > Price.

- Aspirational branding, storytelling, and community engagement matter.

- Buyers want social proof, certifications, trial packs, and easy returns.

- Price Sensitivity:

- 70% of Indian consumers are highly price-sensitive.

- 78% open to switching brands for discounts.

- Loyalty programs, memberships, and subscriptions are key retention tools.

- Convenience:

- 80% expect same-day delivery, 61% want 1–3 hr delivery.

- Cart abandonment ~70% (checkout friction, hidden fees).

- COD still strong, especially ₹900–1,500 range.

- Average Order Value (AOV):

- Rose ~11% YoY (₹1,368 → ₹1,869 in late 2023).

- Driven by jewelry, electronics, and premium beauty.

➡️ Key Insight: High-AOV D2C customers demand trust, speed, and value. Brands must balance premium branding with affordability and convenience.

Build a Sustainable D2C Brand: Avoid Greenwashing

Competitive Landscape: Agencies & Platforms Supporting D2C

- E-commerce Platforms & Tech Enablers

- Shopify (99,000+ Indian stores), WooCommerce, Magento, StoreHippo, Instamojo.

- Logistics: Shiprocket, Delhivery, Bluedart.

- Payment/Checkout: Razorpay, GoKwik, Simpl (BNPL).

- Full-Stack D2C Enablers

- GreenHonchos, ANS Commerce (acquired by Flipkart).

- Offer “one-stop” services: tech, marketing, analytics, operations.

- Performance Marketing Agencies

- Kinnect, Dentsu Webchutney, Techmagnate, iProspect, Digidarts, Social Panga, Blusteak.

- Specialize in ROI-driven ad campaigns (Meta, Google, influencer).

- Aggregators & Marketplaces

- Mensa Brands, GlobalBees acquiring D2C labels.

- Marketplaces like Amazon, Flipkart offering Launchpad for emerging brands.

➡️ Ecosystem is fragmented: brands must juggle multiple partners unless they hire integrated enablers.

Branding Secrets of Best D2C Brands

Service Gaps & Unmet Needs

Despite a mature ecosystem, new manufacturers face hurdles:

- Branding & Differentiation

- Most fail to build unique storytelling or customer loyalty.

- Affordable Marketing & CAC Management

- Rising acquisition costs (~60% over 3 years).

- Lack of retention strategies → <30% repeat customers.

- Digital Infrastructure & Tech Support

- Gaps in GST, vernacular UX, India-first features.

- Lack of continuous tech troubleshooting support.

- Payments & Logistics Optimization

- COD fraud, RTOs, shipping rate negotiation remain pain points.

- Consumer Insights & Feedback

- Few brands leverage A/B testing, surveys, behavioral analytics.

- Mentorship & Education

- Founders lack ongoing guidance in scaling, fundraising, and omnichannel expansion.

➡️ Only 12% of Indian D2C brands are profitable today — highlighting a massive need for better marketing efficiency, stronger branding, and smarter operations.

D2C Brand Site Architecture- Kill Your SEO & Ranking

The D2C market in India (2023–25) is among the fastest-growing globally, expected to hit $100B by 2025. While fashion, beauty, and F&B dominate, niches like pet care, nutraceuticals, sustainable products, and jewelry are unlocking fresh opportunities.

But success requires more than growth. Indian consumers are price-sensitive yet aspirational, expecting trust, speed, and personalization. With rising CAC and low retention, profitability hinges on differentiation, efficient operations, and loyalty-first strategies.

A strong ecosystem of enablers exists — from Shopify to Shiprocket, Kinnect to GreenHonchos — but gaps remain. Agencies and platforms that help brands solve affordability, branding, and operational hurdles will define the next wave of India’s D2C revolution.