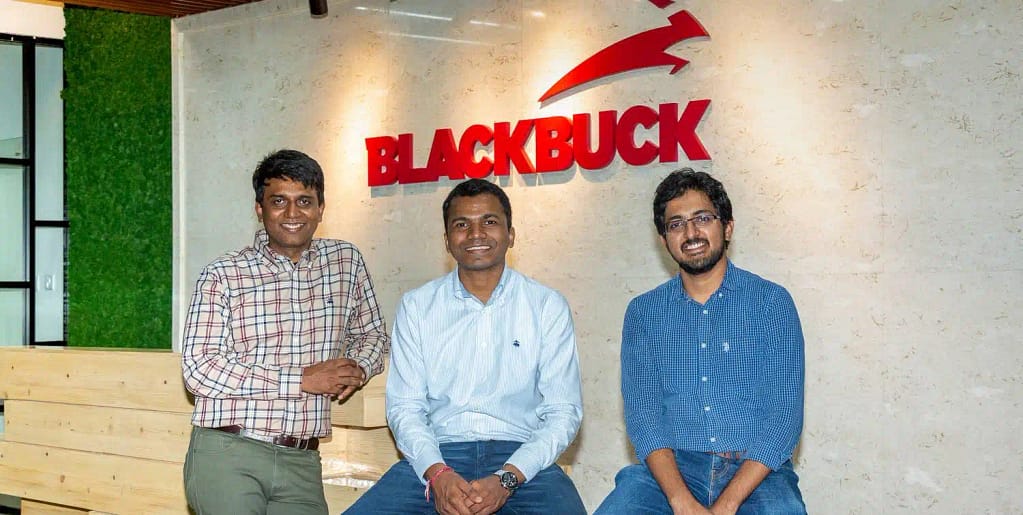

Founded in 2015 by Rajesh Yabaji, Chanakya Hridaya and Rama Subramaniam, BlackBuck operates an online marketplace for inter-city full truck load (FTL) transportation. It claims to be the largest online trucking platform in India, and connects with suppliers with truckers.

The Flipkart-backed logistics unicorn filed its IPO papers with SEBI in July 2024. Its public issue comprised a fresh issue of shares worth INR 550 Cr and an OFS component of up to 2.16 Cr shares. The startup received approval from the Securities and Exchange Board of India (SEBI) for its IPO in October 2024.

Ahead of the IPO, the company raised INR 501 Cr from anchor investors at INR 273 per share. The company had set an IPO valuation of INR 4,800 Cr, a steep 32% discount over its peak valuation of INR 7,100 Cr in 2021.

The public issue of the logistics major saw a muted response and BlackBuck shares listed at INR 279.05 on the BSE, a modest premium of 2.2% against the IPO issue price of INR 273. However, it closed its maiden trading session at INR 260.20, down 4.7% from the IPO price.

The company’s market capitalisation stood at INR 4,591.98 Cr (around $543.8 Mn) at the end of its first trading session.

Backed by the likes of Tiger Global, Accel, Peak XV Partners and Goldman Sachs, BlackBuck raised more than $360 Mn in funding ahead of its IPO.

BlackBuck posted a net profit of INR 28.67 Cr in Q1 FY25 as against a net loss of INR 35.93 Cr in the corresponding quarter last year. Revenue from operations jumped nearly 55% to INR 92.16 Cr during the quarter under review from INR 59.46 Cr in Q1 FY24.

3 thoughts on “BlackBuck”

certainly like your website however you need to test the spelling on several of your posts. Many of them are rife with spelling issues and I in finding it very bothersome to tell the truth then again I¦ll surely come again again.

Spot on with this write-up, I really assume this web site wants much more consideration. I’ll most likely be once more to read rather more, thanks for that info.

Great post, you have pointed out some wonderful details , I too believe this s a very fantastic website.