Bluesmart Cabs | Gensol Engineering | Camellias Gurgaon | SEBI | Corporate Misconduct | Public Money

Anmol Singh Jaggi stands as a significant figure in the renewable energy industry, celebrated for his notable contributions and entrepreneurial spirit. Having founded multiple ventures, his expertise and innovative approach have garnered widespread recognition. As the CEO and co-founder of Gensol Engineering, Jaggi has carved a distinguished path in the engineering and energy sector.

Summary

Anmol Singh Jaggi and Gensol Engineering have shaped India’s renewable energy sector, but recent allegations have placed their reputation under scrutiny.Anmol Singh Jaggi and Gensol Engineering have driven innovation in renewable energy, but face serious allegations of financial misconduct. The resulting investigation and industry response highlight the importance of corporate governance and accountability.

Key Highlights

- Anmol Singh Jaggi, CEO of Gensol Engineering, faces allegations of fund misuse.

- Gensol Engineering, known for solar advisory, uncovered poor internal controls and unaccounted transactions in an investigation.

- Jaggi denies the accusations; the board pledges improved governance and compliance.

- The scandal has damaged Gensol’s reputation and raised industry concerns on ethics and transparency.

- Potential long-term effects include stricter regulations and heightened corporate accountability.

Table of Contents

Anmol Singh Jaggi’s Background and Role at Gensol Engineering

With a solid educational foundation in engineering, Anmol Singh Jaggi’s journey began with his dedication to sustainable solutions and energy efficiency. Before establishing Gensol Engineering, he held key positions in various companies, where he honed his skill set and developed a profound understanding of the renewable energy landscape.

At Gensol Engineering, Jaggi’s role encompasses strategic planning, overseeing operations, and steering the company towards its mission of providing cutting-edge engineering solutions. His leadership has been instrumental in cultivating an innovative environment that continually pushes boundaries, ensuring that the company remains a leader in its field.

Gensol Engineering and Its Significance in the Industry

Gensol Engineering, headquartered in India, specializes in offering comprehensive solar advisory and engineering consultancy services. The firm has made significant strides in the renewable energy sector, focusing on the design, engineering, and consulting of solar projects.

Gensol’s significance in the industry is underscored by its substantial portfolio, which includes numerous milestones in solar project implementation. Key services provided by Gensol Engineering include:

- Design and Development of Solar Power Plants

- Project Management and Consulting

- Performance Assessment and Optimization

- Technical Due Diligence

- Feasibility Analysis and Financial Modelling

Under Anmol Singh Jaggi’s guidance, Gensol Engineering has not only contributed to the growth of solar energy adoption but also emphasized the importance of sustainable practices and innovative technological solutions. The company’s efforts have been pivotal in driving forward the agenda of renewable energy, making a marked impact on the industry.

Timeline of Gensol Engineering and Anmol Singh Jaggi

| Year/Month | Event/Development |

| 2007 | Gensol Engineering founded, focusing on carbon-credit advisory. |

| 2010 | Gensol becomes a top 5 carbon consultant in India. |

| 2015 | Launch of Param Renewable Energy for O&M services. |

| 2018 (Oct) | Gensol Mobility Pvt Ltd (later BluSmart) incorporated as a Gensol subsidiary. |

| 2019 (Jan) | BluSmart Mobility founded by Anmol Singh Jaggi, Puneet Jaggi, and Punit K Goyal in Gurugram. |

| 2019 (July) | BluSmart raises $3M in angel funding. |

| 2019 | Gensol diversifies into electric mobility with BluSmart and develops EV charging network (BluCharge). |

| 2019 | Gensol Engineering listed on BSE SME platform. |

| 2020 (July) | BluSmart launches multi-hour rentals and in-app wallet. |

| 2020 (Aug) | BluSmart raises $7.8M pre-Series A funding. |

| 2021 (Q4) | Partnership with Tata Motors to expand EV fleet and MoU with Jio-BP for charging infrastructure. |

| 2022 (May) | BluSmart raises $25M (equity and debt); starts Bengaluru operations. |

| 2022 | Gensol launches EV manufacturing and fleet leasing solutions. |

| 2022 (Sept) | BluSmart crosses Rs 400 crore ARR; fleet exceeds 5,000 EVs. |

| 2023 (May) | BluSmart raises $42M; Mayfield India exits, selling stake to Jaggi. |

| 2023 | Gensol acquires Scorpius Trackers and enters gas distribution. |

| 2023 | Gensol migrates to NSE Main Board. |

| 2024 (Jan) | BluSmart raises $25M from ResponsAbility for charging infra. |

| 2024 (Feb) | BluSmart powers 6,000 EV fleet with Tata Power solar energy. |

| 2024 (Apr) | BluSmart posts Rs 390 crore FY24 revenue; raises $24M more. |

| 2024 (July) | BluSmart secures Rs 100 crore in EV financing under asset leasing. |

| 2024 (Dec) | Refex terminates deal to acquire 2,997 EVs from Gensol. |

| 2025 (Jan) | Gensol sells 3,000 EVs (leased to BluSmart) to Refex Green Mobility to reduce debt. |

| 2025 (Mar) | Uber reportedly in talks to acquire BluSmart; BluSmart plans to pivot as Uber fleet partner. |

| 2025 (Apr) | SEBI bars Gensol founders from top roles over BluSmart debt issue; BluSmart suspends bookings. |

Details of the Allegations Regarding Fund Misuse

In a startling turn of events, Anmol Singh Jaggi, a high-profile figure associated with Gensol Engineering, finds himself embroiled in controversy. Accusations of financial misconduct and fund misuse have surfaced, rocking the industry and raising numerous questions. Let’s take a closer look at the specifics of these allegations.

Accusations Against Anmol Singh Jaggi

It has been alleged that Anmol Singh Jaggi engaged in misusing funds allocated to Gensol Engineering. These accusations suggest that Jaggi diverted funds away from their intended purposes. Such actions, if proven true, could constitute a breach of fiduciary duty and could have legal implications.

Specific Instances of Alleged Financial Misconduct

The allegations detail several specific instances of purported fiscal impropriety:

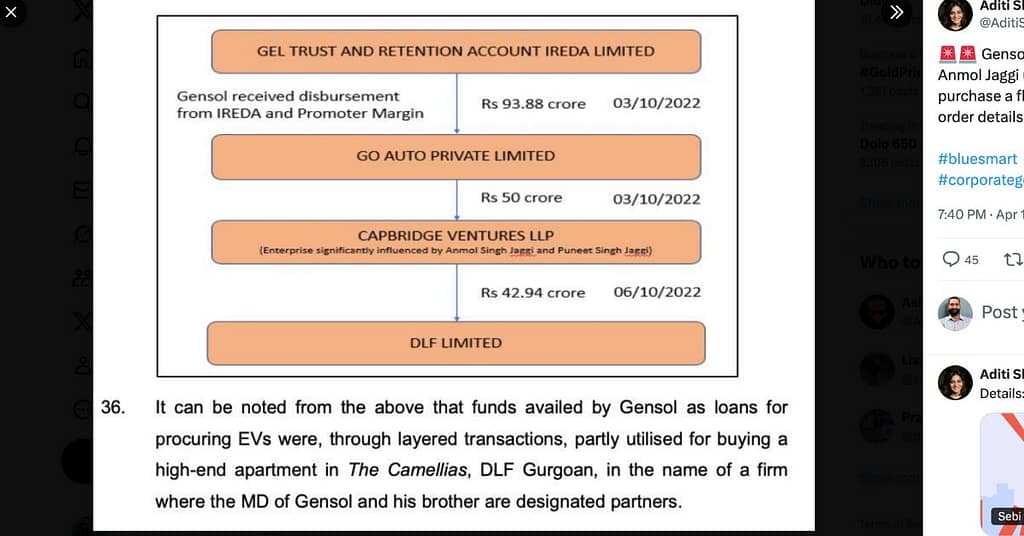

- Unauthorized withdrawals: There are claims that Jaggi authorized withdrawals from company accounts without proper approval or documentation.

- Personal expenses funded by the company: Reports suggest that some expenditures categorized as business expenses were, in fact, personal in nature.

- Manipulation of financial records: Allegations include the accusation that Jaggi or his associates manipulated financial data to cover up the misappropriation of funds.

Timeline of the Allegations

The timeline of these allegations is as follows:

- Initial concerns regarding financial discrepancies begin to surface internally within Gensol Engineering.

- An internal audit is triggered to investigate these discrepancies.

- Findings from the audit lead to formal accusations being brought against Anmol Singh Jaggi, sparking a comprehensive investigative report.

As the investigation continues, the industry watches closely. The implications of these allegations are significant, both for Gensol Engineering and the professional standing of Anmol Singh Jaggi.

Investigation Report and Findings

The recent allegations against Anmol Singh Jaggi, claiming fund misuse at Gensol Engineering, have stirred quite a buzz. To address these serious accusations, a thorough investigation was launched. Here’s an overview of the investigation process, the key findings, and responses from those involved, including Anmol Singh Jaggi himself.

Overview of the Investigation Process

A committee was formed to conduct a detailed probe into the claims of financial misconduct. The investigation team was comprised of internal auditors and independent third-party consultants to ensure impartiality. The scope of the investigation included:

- Reviewing financial statements and transactions over the past five years

- Interviewing key personnel and stakeholders

- Examining internal controls and compliance with corporate governance standards

- Cross-referencing findings with industry benchmarks

Key Findings from the Investigation

The investigation uncovered several critical issues, which were detailed in the final report:

- Unaccounted Transactions: A substantial number of transactions lacked proper documentation and approval, raising red flags about financial transparency.

- Excessive Expenditures: Certain expenditures were found to be significantly higher than the industry norm, suggesting potential misuse of funds.

- Poor Internal Controls: The internal controls within Gensol Engineering were identified as insufficient to prevent or detect fraudulent activities.

- Conflict of Interest: Potential conflicts of interest were highlighted in some contracts awarded to third-party vendors with known connections to key executives.

Responses from Involved Parties

In response to the findings, the involved parties, including Anmol Singh Jaggi, provided their statements. Here are the key points from their official responses:

- Anmol Singh Jaggi: He firmly denied any wrongdoing, asserting that all financial transactions were made in the best interest of Gensol Engineering. Jaggi emphasized his commitment to transparency and cooperation with the investigation.

- Board of Directors: The board acknowledged the shortcomings highlighted in the report and assured stakeholders that remedial measures would be implemented to strengthen internal controls and ensure compliance.

- Third-party Consultants: They recommended a comprehensive overhaul of the company’s financial oversight mechanisms, including more rigorous audits and enhanced governance protocols.

As the investigation report sheds light on these critical issues, the focus now shifts to how Gensol Engineering will address and rectify these lapses to restore stakeholder confidence.

Impact on Gensol Engineering and the Industry

Effect of the Scandal on Gensol Engineering’s Reputation and Operations

When the allegations against Anmol Singh Jaggi for misusing funds first surfaced, Gensol Engineering found itself at the center of a major controversy. The company’s reputation, which was built over years of consistent performance in the industry, faced immediate jeopardy. Stakeholders began to question the integrity of its operations and financial management. Clients and investors started to express concerns, and there was a noticeable impact on Gensol Engineering’s business dealings. The company had to put in substantial effort to manage the fallout and attempt to restore its image amidst these serious allegations.

Reactions from Industry Peers and Stakeholders

The industry reaction was swift and polarizing. Many of Gensol Engineering’s peers in the industry expressed shock and disappointment. Comments from industry leaders highlighted the need for stringent financial controls and governance within companies to prevent such scenarios. Stakeholders, including investors and clients, demanded immediate clarification and a detailed investigation report. This crisis not only put Gensol Engineering’s internal policies under scrutiny but also triggered a broader conversation about ethical practices and financial transparency in the sector.

Potential Long-Term Consequences for the Company and the Industry

The long-term consequences of this scandal could be profound for both Gensol Engineering and the wider industry. For the company, there is the risk of losing major contracts, facing prolonged financial instability, and enduring a sustained blow to its reputation. They may also have to deal with legal repercussions and potentially restructure their management and operational practices. For the industry at large, this incident serves as a wake-up call to enhance regulatory standards and governance mechanisms. Increased oversight, possibly in the form of tighter financial audits and compliance checks, could become the new norm. The scandal has undoubtedly placed greater emphasis on corporate accountability, potentially leading to more robust measures to prevent financial misconduct in the future.

Conclusion and Future Outlook

As we draw to a close, it is important to recap the essential points discussed in relation to the allegations facing Anmol Singh Jaggi and Gensol Engineering. The company has been rocked by accusations of financial misconduct, centering around the misuse of funds. An investigation report has brought to light various facets of this corporate scandal, leading to significant scrutiny of corporate governance and accountability within the industry.

Key Points Recap

Throughout our discussion, we’ve explored several key elements:

- Anmol Singh Jaggi faces serious allegations concerning financial misconduct.

- The accusations have prompted an investigation into the misuse of funds at Gensol Engineering.

- Details and outcomes from the investigation report have significantly impacted the industry.

- This scandal has highlighted the critical need for robust corporate governance and accountability mechanisms.

Speculation on Potential Outcomes and Future Developments

Looking ahead, the potential outcomes of this situation could shape the future of Gensol Engineering in various ways. Possible repercussions might include:

- Stricter regulatory scrutiny and reforms within the industry to prevent future occurrences of fund misuse.

- Increased transparency and stricter internal controls within corporations, particularly in financial management.

- Potential legal ramifications for those found guilty of financial misconduct.

- A shift in investor confidence and public perception towards Gensol Engineering and its leadership.

The unfolding story will likely bring about meaningful changes, not only for Gensol Engineering but across the industry as a whole. This development serves as a cautionary tale about the importance of ethical practices and vigilance in corporate finance.

Corporate Governance and Accountability

In conclusion, the allegations against Anmol Singh Jaggi and the subsequent investigation at Gensol Engineering underscore a critical aspect of the business world: the essential role of corporate governance and accountability. For companies to thrive and sustain trust with stakeholders, implementing robust governance structures and transparency is non-negotiable. The industry must reflect on this incident and address any gaps in regulatory frameworks to safeguard against future misconduct. Learning from this challenging chapter, corporations can strive toward a more ethical and accountable future, ensuring that integrity forms the bedrock of their operational ethos.

Follow d2ctoday for Latest News and Startup Stories